Reflecting on 2025 and What’s to Come in 2026

Here’s to a Strong New Year ✨

Dear Bitcoiners,

2025 is coming to an end, an underwhelming year for Bitcoin. In this final newsletter of the year, we’ll reflect on what has been happening and what’s to come in 2026.

Reflecting on 2025

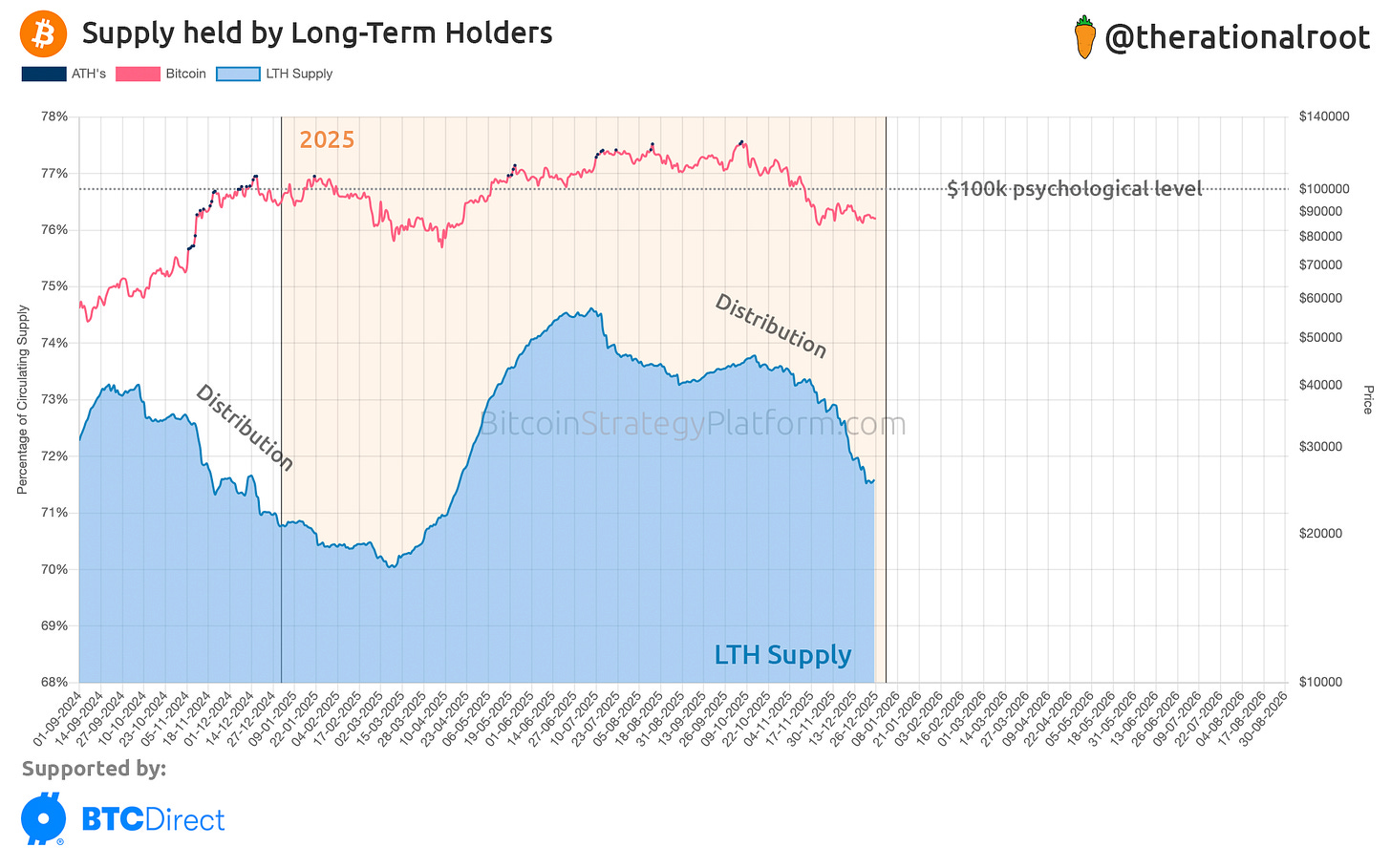

👉 Key Insight: 2025 has been a distribution phase around the $100k psychological level, much like the distribution phase around $10k from mid-2019 through October 2020.

Sentiment is at a low due many uncertainties within the Bitcoin community. First, price performance has been underwhelming, which has created doubt among hodlers. Is Bitcoin still progressing in terms of adoption?

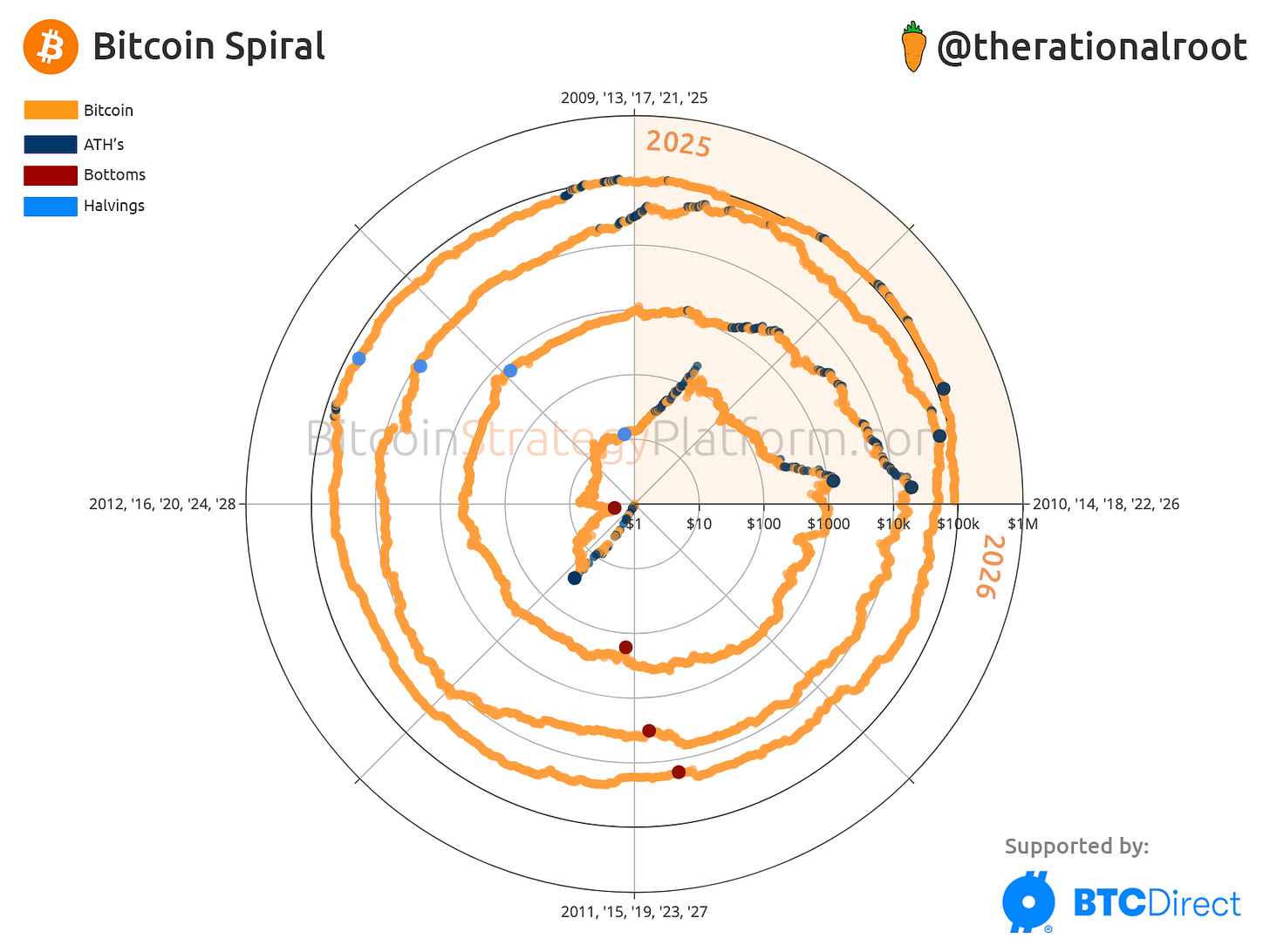

Next, there is uncertainty around market structure. Are we still in a 4-year cycle? Are we heading into a full bear market year? And on top of that, there is the quantum threat.

All of these uncertainties are unfolding after reaching the $100k psychological level and during what we call Bitcoin’s “IPO moment.” Reaching $100k made Bitcoin markets deep and liquid enough for OGs to take profits. Early holders from e.g. 2011 simply could not cash out thousands of Bitcoin in the past without affecting the market.

The data clearly backs up the ongoing profit-taking from the hodler cohort. In previous newsletters, we discussed the effect of compounded hodler sell pressure, as each cycle sees price and liquidity increase by an order of magnitude. 2025 may have been a flat year, but for many OGs these price levels and deep market liquidity remain very attractive. We are dealing with a distribution phase that needs time, but like any distribution phase, it will eventually come to an end.

Bitcoin and Macro

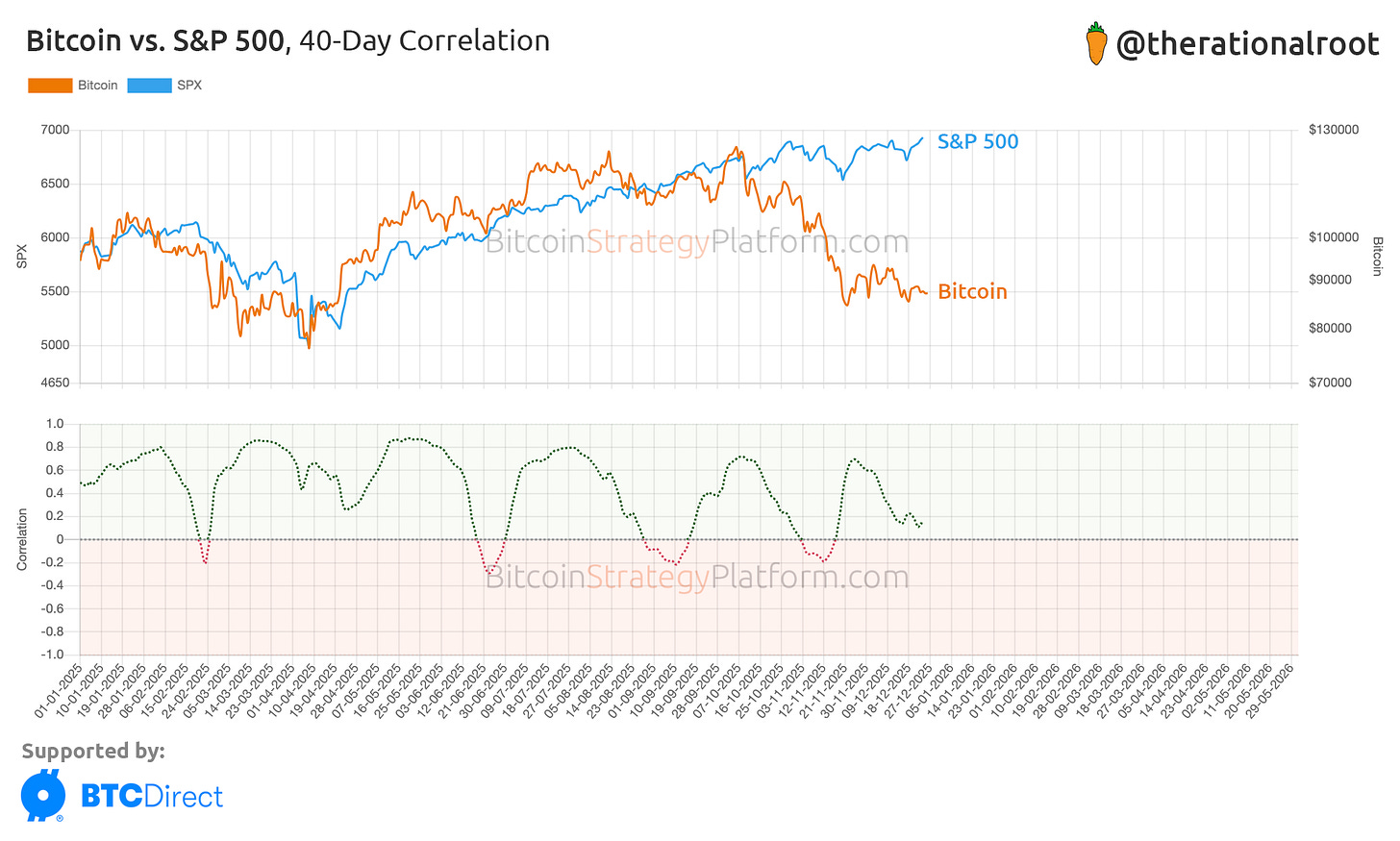

As Bitcoin has matured and its correlation with risk assets has increased, it has become more closely tied to the broader macro landscape. This makes Bitcoin’s market behavior increasingly complex and adds uncertainty around the 4-year cycle and the business cycle, a topic we have discussed extensively.

Then there is gold at all-time highs, a major macro signal of uncertainty. Central banks are accumulating gold, not Bitcoin, as trust in the U.S. dollar fades. For the Bitcoin community, seeing analog gold outperform digital gold is a hard pill to swallow.

Not only is gold at highs, but equities and real estate are also at high valuations, while the real economy is far from doing great. The effects of COVID and post-COVID market intervention have distorted traditional recession signals. There is uncertainty around tensions between the U.S. and Europe. We have ongoing wars and elevated inflation. For now, capital is mainly flowing into gold, equities, and real estate, and less so into the new and risky asset class that is Bitcoin.

When you sum up all of these circumstances, it becomes clear why confidence in Bitcoin is crushed. But with gold at highs, equities at highs, and real estate at highs, the tide can also suddenly shift. Bitcoin can quickly become an underappreciated asset and turn into an attractive investment. There are many powerful underlying developments that are not yet reflected in price.

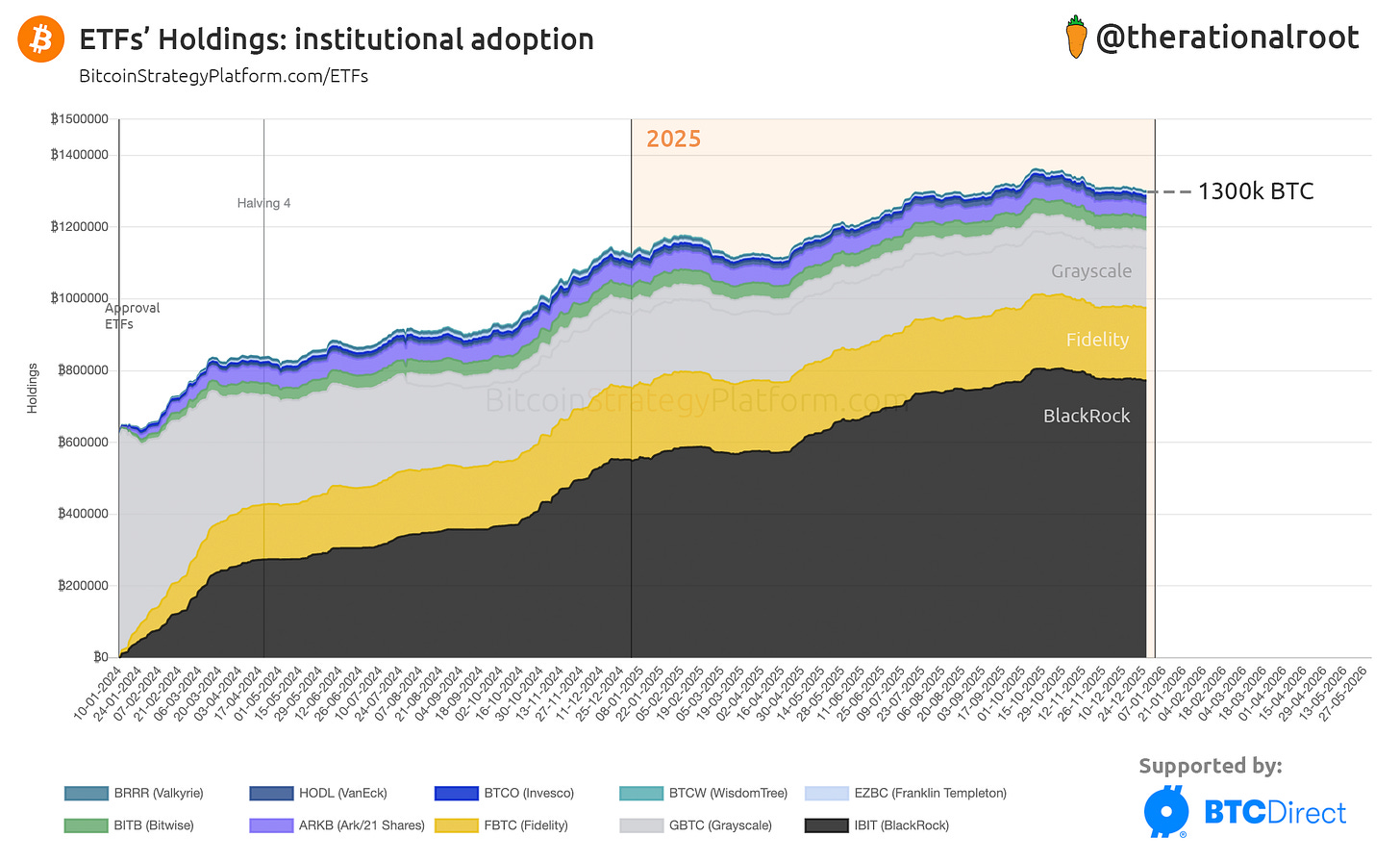

Let’s summarize these underlying developments. Financial institutions are pivoting. For example, Bank of America has become involved. Vanguard, historically one of the most anti-Bitcoin legacy firms, is entering the market. We are seeing the normalization of Bitcoin ETFs, with BlackRock benefiting from the most successful ETF launch in its history.

Regulatory clarity is improving across jurisdictions. Institutional green lights are happening behind the scenes. Pension funds and asset managers are preparing exposure. Yet there is still a large amount of trapped institutional capital that cannot buy spot Bitcoin. Treasury companies are helping to solve this through fixed-income products.

So why are these developments not reflected in price? This is the first cycle with easy gateways for the TradFi system into Bitcoin. ETFs and treasury companies are extremely recent developments that only emerged this cycle. Institutions are literally just getting their feet wet. Additionally, we are coming from years of a hostile regulatory stance toward the industry, a stance that has only begun to change since 2025, and primarily in the U.S.

What to Expect for 2026?

I’m not here to tell you I can predict what will happen in 2026. Given the uncertainties surrounding both Bitcoin and the macro environment, there are many ways things could unfold, ranging from a flat market to Fourth Turning–style volatility in both directions.

But this does not have to be an unsatisfying answer. There is a lot we do know:

It’s best to treat Bitcoin as if we are in a bear market

We are in a bearish trend after breaking the 3-year bull market structure

The majority of on-chain indicators point to a bearish or sideways period before conditions improve

Bitcoin is currently trading around fair-value on-chain price levels

Because we never reached overvalued levels, downside risk should be dampened

We mapped out downside risk through 👉 clearly defined support levels

Some indicators conflict with the bearish view, such as STH supply, which remains in an uptrend

We identified clear 👉 resistance levels that must be reclaimed before further upside is possible

A ~month ago we had a capitulation wick, that so far is holding up.

These positive signals align with an extended business cycle, as observed via the ISM PMI

Current distribution, similar to 2019/2020 could come to an end

We have transitioned from QT to an early form of QE, and liquidity conditions are likely to improve

Midterm elections are approaching, creating incentives to support the economy

Further rate cuts are likely

At the same time, there is a disconnect between financial markets and the real economy

Recession indicators, such as unemployment, are worsening

These observations allow us to make informed, risk-adjusted decisions.

Gain access to all future full newsletters and the Bitcoin Strategy Platform, including all live charts. Sign up today and claim a 25% LIFETIME discount!

While I believe there is a high probability that Bitcoin will perform better in 2026 than it did in 2025, it remains a game of probabilities. To protect against downside risk, I plan to cash out a small portion on the next move toward the STH cost basis. This serves as insurance in case a persistent downtrend lasts longer than expected, may it be due to macro-economic factors.

If Bitcoin moves higher, I’m completely fine with that outcome, as my original cost basis is much lower and this decision is based on the current data. There is no shame or blame in managing risk.

I’m truly looking forward to exploring the next year together with all of you. 👊

We’ve talked a lot about uncertainty, but my long-term belief in Bitcoin remains completely unshaken. Bitcoin is a global market with an incredible community and strong incentives. Believe me, hype will be back. Even without fundamentals it would return, simply due to Bitcoin’s size, community, and narrative. But we know the fundamentals are real.

Hype. Will. Be. Back.

I wish you all the best for 2026. 🧡✨

Until next year, 🫡

-Root

Hi, I’m a paying subscriber, but I’m having trouble accessing the Live Charts links. When I click on them, I’m redirected to a login page that asks for my email and password, but it won’t let me log in. I’ve already reset my password, and the issue persists.

Am I missing something, or is there an issue with my account? I’d really like to access the Live Charts included in my subscription.

Could someone please help me with this? Thank you! 🙌

Root, dude, all this tough love! But thanks ongoing for presenting all sides, and see you on the other side in 2026.