Short-Term Outlook

New chart: Resistance Levels

Dear Bitcoiners,

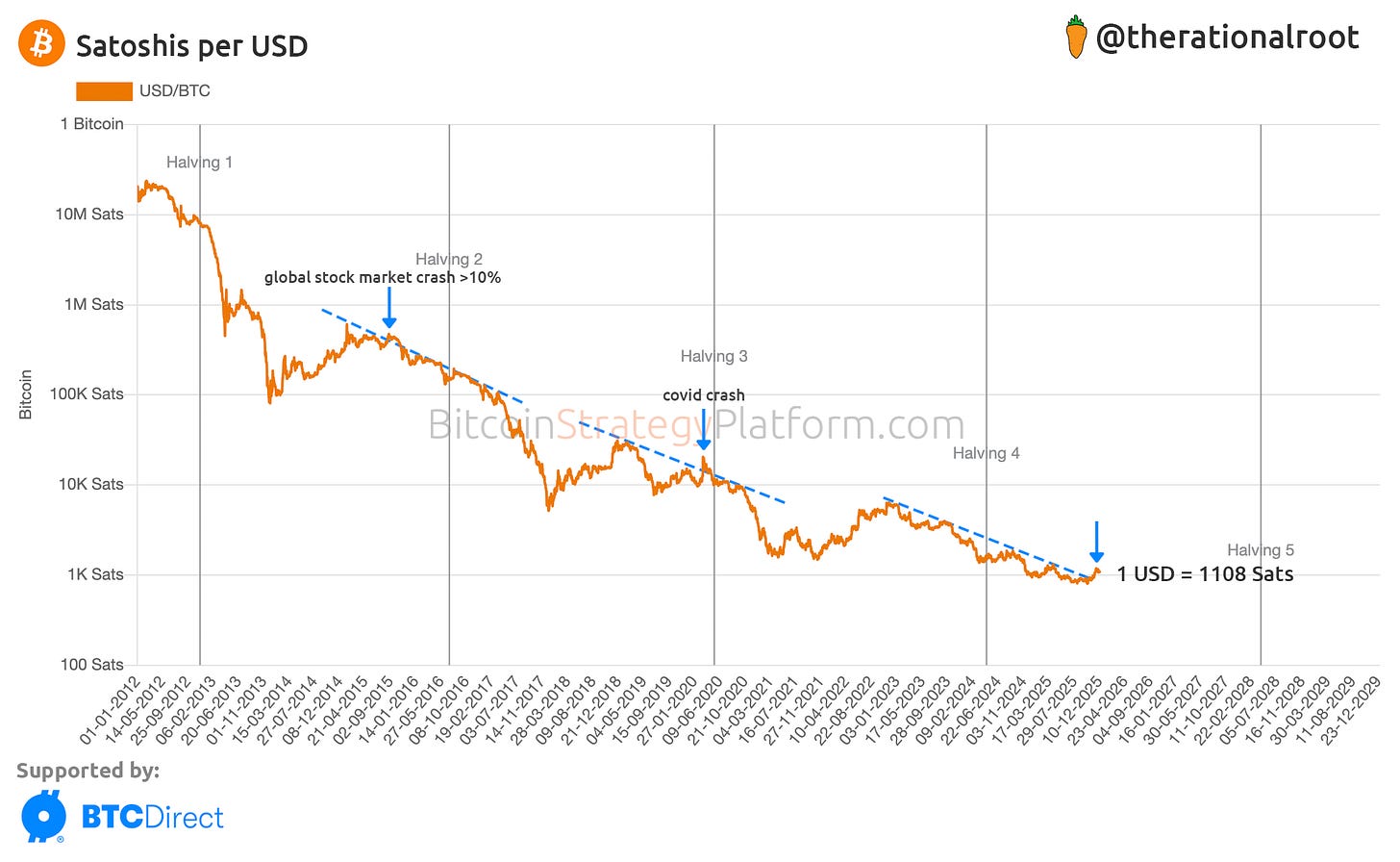

At Bitcoin Strategy, we’ve continuously stated that there’s a high probability Bitcoin will follow the business cycle rather than its historic halving-cycle pattern, for the following reasons:

Highly correlated to risk assets

A near multi-trillion-dollar, institutional-grade asset

Heavily impacted by institutional capital, ETF flows, and treasury companies

Liquidity sensitive

That said, because we broke down from a 3-year bull market trend and fell below key levels, our practical approach has been to treat Bitcoin as if we are in a bear market. Only if we recover above several major levels can the bull market continue.

Last week, we looked at Bitcoin’s highly positive correlation with the S&P 500, both behaving as risk assets. We concluded that the severity of this drawdown was industry-specific, catalyzed by the largest liquidation event in crypto history, and compared it to previous industry-specific events like the China mining ban. We also discussed how risk-asset performance within the broader business cycle can potentially pull Bitcoin back up. If you haven’t read that newsletter, you can find it here:

Interestingly, Jordi Visser, famous for saying “Bitcoin is having its IPO moment”, a brilliant analogy for behavior we’ve discussed, came out this week with nearly the same conclusion as in last week’s newsletter: risk assets are nearly recovered… and Bitcoin might be next.

Is Bitcoin next?

In this newsletter, we’ll discuss the key resistance levels Bitcoin must break to continue a bull market, and we’ll discuss a realistic short-term outlook.

Two weeks ago, we combined all key support levels to analyze how far Bitcoin could drop if the bear market continues. This week, we take the same approach, and combine key resistance levels Bitcoin must recover to continue a bull market.

Gain access to full newsletter content and the Bitcoin Strategy Platform, including the new live charts for resistance and support levels. Sign up today and claim a 25% LIFETIME discount!

Short-Term Outlook and Resistance Levels

From a business-cycle perspective, and based on our comparisons with the S&P 500, Bitcoin is in an undervalued state. Jordi Visser came to the same conclusion: based on risk-asset trends, Bitcoin still needs to catch up within the broader business cycle.

Unlike previous cycles, we never had a parabolic uptrend and Bitcoin dropped far more severely than other risk assets. This puts Bitcoin in an incredibly attractive position, similar to the COVID collapse!

👉Key insight: Previous breaks below the cycle trend were driven by macro shocks, but this one is crypto-specific, triggered by the largest liquidation event on record.

Is this a COVID-like moment where Bitcoin catches up, and if so, over what timeframe?