Dear Bitcoin Enthusiasts,

This week has been a whirlwind: Argentina welcomes a Bitcoin-friendly president, and Binance’s CEO admits to the US government regarding financial misconduct. Amidst this, Bitcoin’s supply remains steadily contracting. Let’s discuss these topics more in-depth.

The US government’s crackdown on Binance, the world’s largest crypto exchange, was not unexpected, but its timing is certainly intriguing. Last week, we discussed the ETF approval challenges, highlighting the need for market integrity, particularly around Binance’s trading activities. Now, Binance has consented to maintain an independent compliance monitor for five years, marking a significant stride toward regulatory compliance. This development further enhances the prospects of a Spot ETF approval by January 10th, potentially unlocking substantial capital inflow into the Bitcoin market.

Have you missed last week’s discussion? You can find it below. Also, make sure to read the comments as there are insightful questions.

Next, we turn to Argentina’s political scene. Typically, I steer clear of politics, but the implications for Bitcoin are too significant to ignore. Although the media labels Argentina's new president, Javier Milei, as "far-right" due to his populist approach, his views are a blend of libertarianism and Austrian economics principles. For a primer on why Austrian economics matters to Bitcoin, I recommend this presentation by Stephan Livera and Peter St Onge.

Milei issued an official statement yesterday, stating that the closure of the Central Bank is non-negotiable. With the dollar’s widespread popularity in Argentina, dollarization seems imminent. However, Milei aims to allow currency competition, giving citizens the freedom to choose, including using Bitcoin. While El Salvador’s Bitcoin move involved a smaller economy, Argentina’s much larger economy (22nd in the world) makes this a big deal. A word of caution: Whether he can implement all of his ideas remains to be seen. His party 'La Libertad Avanza,' does not have a majority in Congress or the Senate, and he will likely have to enter into political collaborations with other parties to implement his plans.

Access to the Bitcoin Strategy Platform with LIVE indicators and charts .

Grab the 30% discount before it ends.

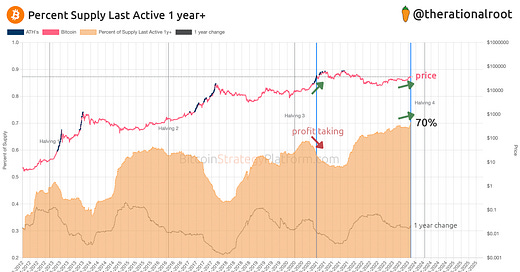

Now, back to Bitcoin. HODLers remain unfazed by the news. In past newsletters, we’ve examined HODLing behaviors through Long-Term Holder Supply and Illiquid Supply. This week, we add another dimension: supply that hasn’t moved in over a year.

70% of the supply hasn’t moved in a year, hitting an All-Time-High.

Below, the chart shows the cyclical nature of Bitcoin Cycles. Historically, tight supply leads to price increases, which in turn stoke curiosity and new demand. This demand leads to hype, exponential price increases, and eventually, profit-taking.

👉 This fascinating chart, which I recommend to keep an eye on, is now available live on the Bitcoin Strategy Platform for paid subscribers.

Key Insight

Supply is tight and climbing, whereas, during the last bull market, it was in a downtrend. This implies that the market is not overheated.

As we navigate these intriguing developments, feel free to share the newsletter if you find it valuable.

Until next week! 👊

-Root

Thank you Root. Do you think we're due for a correction to $30k in the next few months? I've been DCA'ing but I still have a chunk of money left and wondering.

Thanks for that article on Austrian Economics - I live there part of the year and what they are doing is, to me, incredible. People are generally happy, there is a safety net for all, the government seems quite responsive and responsible to the populace. Inflation didn't seem nearly as bad, regarding food prices, as it was/is in USA and living/rent is controlled and obtainable. Yes they complain about taxes but very few want to give up Austrian citizenship for American citizenship. :-o

While I’m careful to not become overly euphoric, I am more excited about this upcoming cycle than any previously. The combination of institutional demand via spot ETFs, decreasing supply available, FASB accounting rule changes, and potentially further nation state adoption seems to be an almost unimaginable setup for bull market run we’ve not seen. I’m not entirely sure the argument of diminishing returns is totally true with bitcoin as we have never experienced an asset with truly limited supply.