Dear Bitcoiners,

While it may have felt like Bitcoin has been moving sideways, the last three months tell a different story. Since the 30% drawdown, we’ve been making higher lows and are now just 8% away from the previous ATH. This week, based on our cycle analysis, we’ll explore the psychological phase we’re in. Plus, I’ll introduce a New Chart that highlights an important on-chain indicator, offering fresh insights into what may come next.

Last week, we discussed how Bitcoin is Back in Bullish Territory, trading above key levels, and covered an important on-chain signal. If you missed that newsletter, I highly recommend checking it out here:

Q4: The Optimism Phase

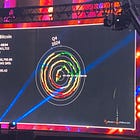

While the ‘Uptober’ meme circulates on social media, Bitcoin’s performance should really be viewed through the lens of the 4-year cycle rather than a year-to-year comparison. Monthly performance can vary greatly depending on the stage of the cycle. Instead of using every year’s data, which would result in 12 datapoints, we focus on the cyclical pattern, which unfortunately provides only three datapoints. In the chart above, seasonality is highlighted, showing Q4 performance across the different years. The orange arrows represent the ‘current’ stage in the 4-year cycle from 4, 8, and 12 years ago, respectively.

Get access to premium live indicators, charts, and full newsletter content—sign up now and receive a 25% lifetime discount.

As discussed in my Amsterdam keynote, Q4 during this stage of the cycle marks the 'Optimism' phase. Historically, this phase has coincided with more bullish price action.

Will this time be different? Let’s look at a New Chart that offers important on-chain insights into what may lie ahead.