Hello Bitcoiners!

What an exciting week of price action! After months of consolidation following the premature all-time high caused by ETF excitement, Bitcoin is once again pushing boundaries.

What’s Happening

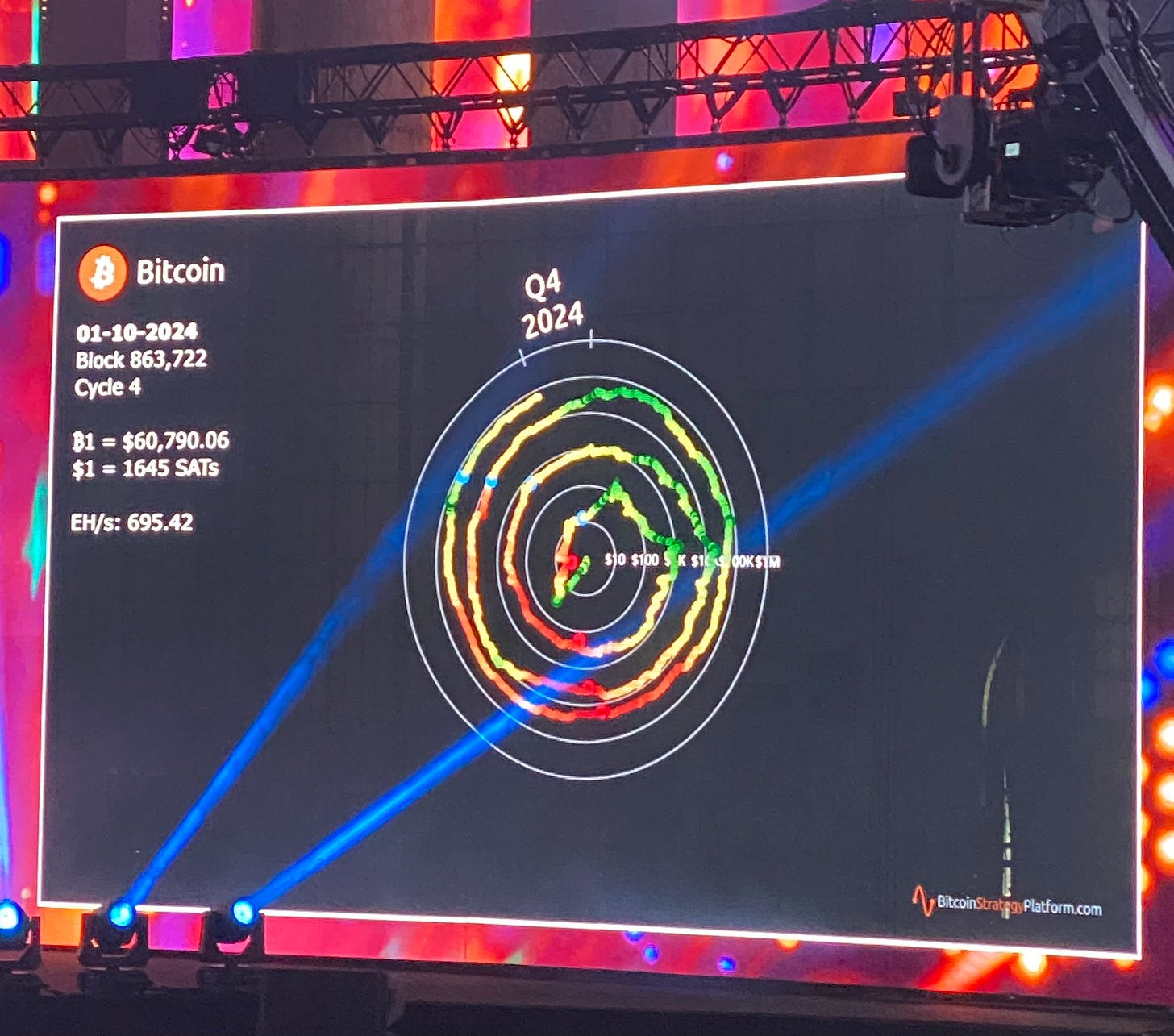

From a cyclical perspective, we saw an early overextension, and we’ve been witnessing a reversion to fair value ever since. Now, we’re approaching the point in the cycle where Bitcoin historically takes off.

ETF flows have surged this week, with the highest absorption ratio compared to new supply issuance.

Global liquidity is improving as interest rates start to come down. Rate cuts make short-term T-bills less attractive, prompting investors to shift their capital to the “riskier” end of the curve.

On-chain insights: Let’s take a closer look at the Short-Term Holder (STH) cost basis and STH supply!

Platform Upgrade

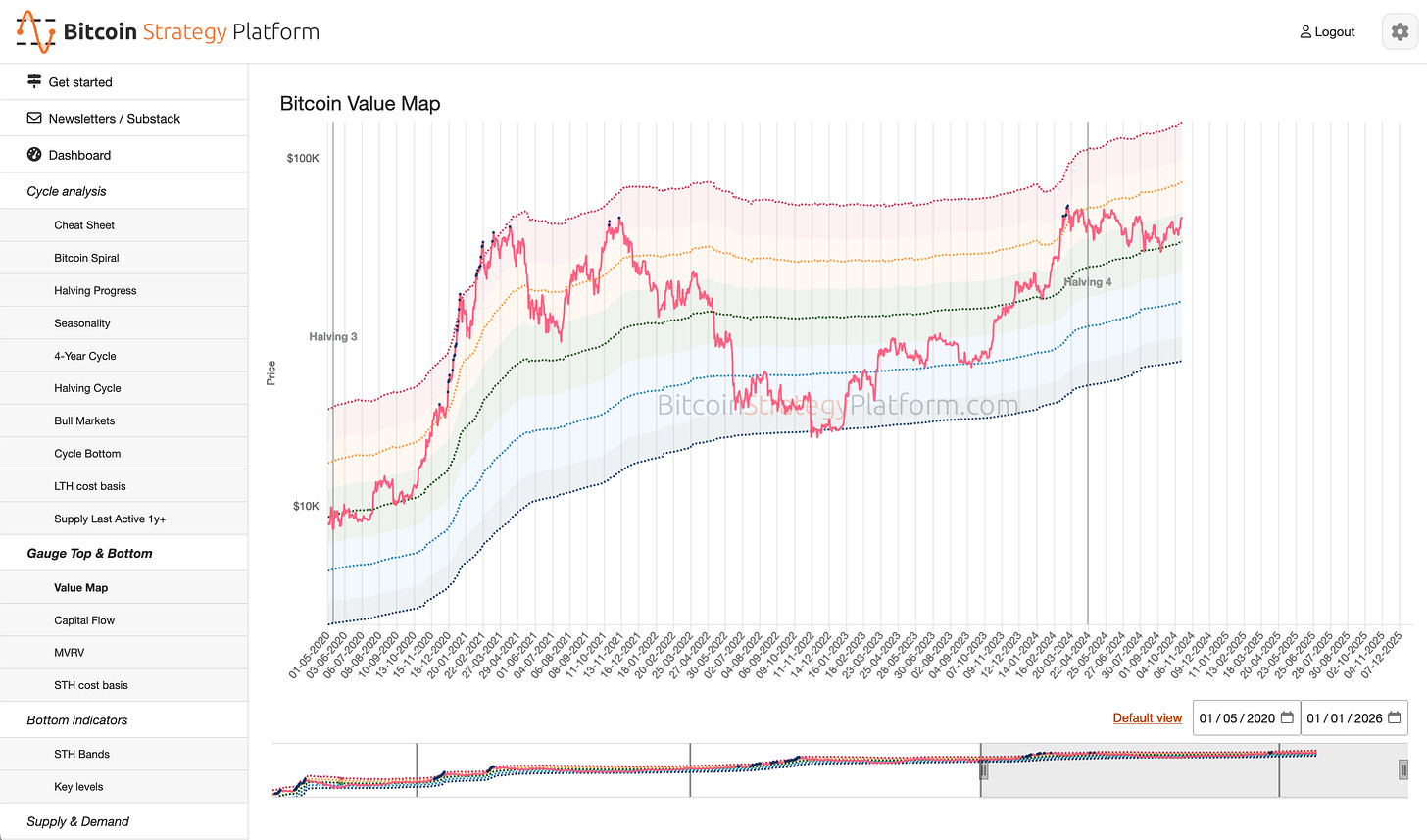

This week, I’m excited to announce a major platform upgrade! Zoom functionality has been added to the Bitcoin Strategy Platform, allowing you to dive even deeper into key charts like the On-Chain Value Map, STH Bands, and Key Levels. Everything on the platform is custom-built, meaning these charts are optimized for Bitcoin-specific insights, like displaying the Halvings. Get access to the best premium live indicators and charts, all in one place, to stay fully prepared for Bitcoin's cycle. Get access to the platform today with a 25% lifetime discount!

This week’s price action has pushed Bitcoin back into bullish territory, but a key on-chain metric I’ve been watching closely is now revealing even more significant insights!