Midterm Season

The business cycle and Bitcoin

Dear Bitcoiners,

In this newsletter, we’ll discuss the midterm election, its implications for the economy, and what it means for Bitcoin.

In last week’s newsletter, we discussed how expectations for 2026 are low while the business cycle is diverging. Bitcoin’s correlation with risk assets is high, and due to ETFs and derivatives markets, Bitcoin is now much more integrated into the TradFi system. The macroeconomic outlook will therefore have a bigger impact on Bitcoin than ever before.

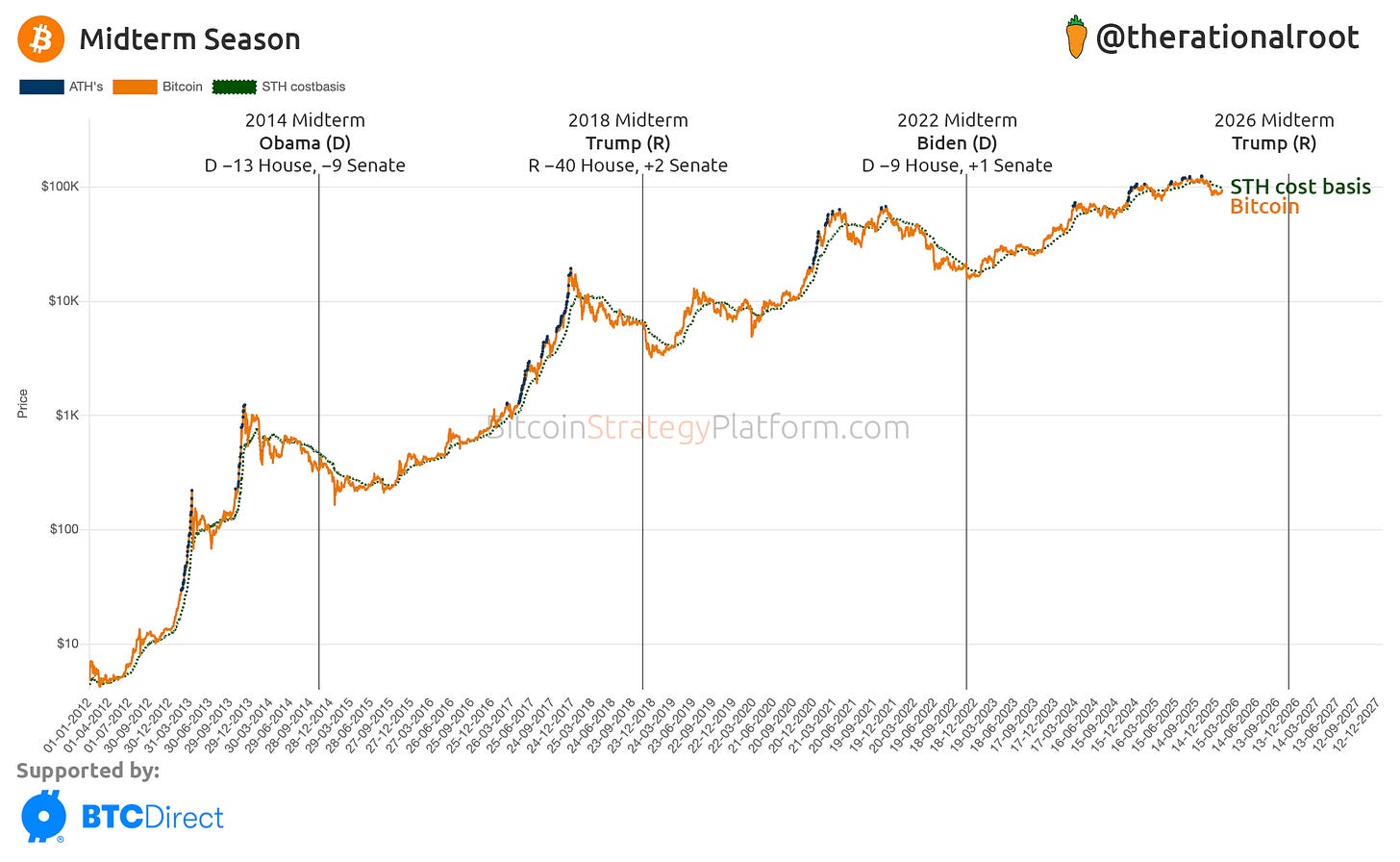

Midterm Season

Will the economy perform well because of the midterm elections? We’ve mentioned before that there is a political incentive to support economic strength ahead of the midterm elections. A booming economy can win over voters, but more importantly, it helps avoid losing seats in Congress, which allows a president to govern more effectively in the second part of the term.

👉 Key insight: The hard truth is that midterm elections have historically aligned closely with cycle bottoms.

The chart above shows that midterm elections, and the year leading up to them, have historically not been positive for Bitcoin. In fact, markets were often in downtrends, and the midterms nearly marked bear market bottoms.

Gain access to the Bitcoin Strategy Platform with all premium curated live charts and indicators. Claim your 25% lifetime discount today!

Like Bitcoin, elections (and midterms) follow a 4-year cycle. In fact, the election cycle is likely a major driver of the 4-year business cycle, and with it, Bitcoin’s 4-year cycle.

Historically, sitting presidents tend to lose popularity leading up to midterms, as expectations are rarely met. Of course, broader macroeconomic and political dynamics also play a role as power swings between parties. This time, however, we are seeing a divergence in the business cycle, as observed in the ISM PMI (chart shown below).

In the chart below, we zoom out beyond Bitcoin’s history and into the 1990s by observing the S&P 500. This allows us to study how the business cycle and risk-on markets behaved during previous midterms and whether this time is different.