Dear Bitcoiners,

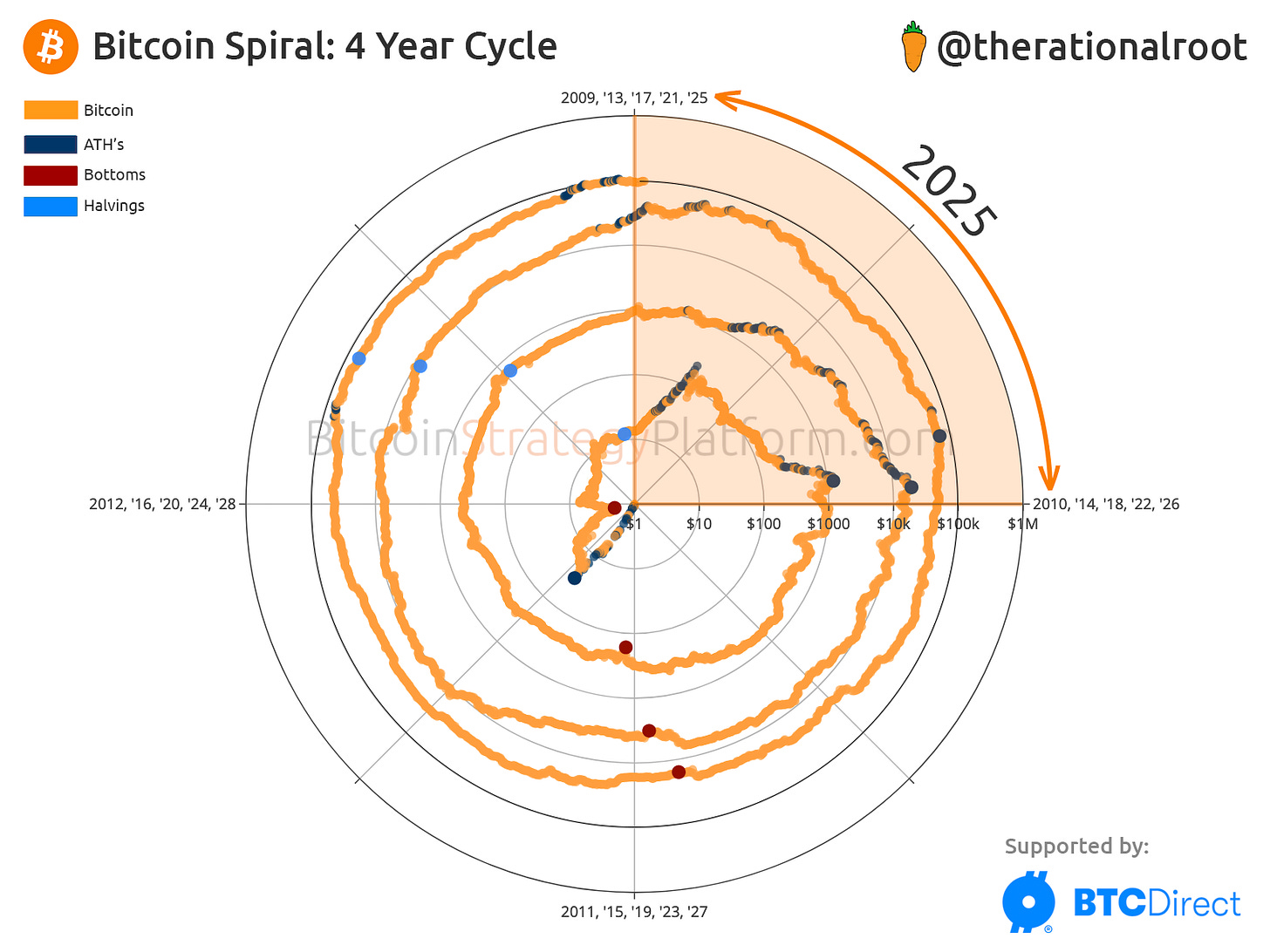

Happy 2025! What an absolutely exciting year for Bitcoin. As illustrated by the spiral chart, 2025, represented by the first quadrant, is the year with historically the most upside potential! Nearly all ATHs, shown by the blue dots, occur within the first quadrant.

The lineup of events leading up to this year in the cycle are truly phenomenal:

ETF Approval

BlackRock advocating a 2% allocation 🤯

Global discussions of a Strategic Bitcoin Reserve 🤯

Adoption of MicroStrategy’s playbook: increasing Bitcoin per share

A View on 2025

2025 will be the first year with a pro-Bitcoin U.S. administration! We’re now just two weeks away from Trump’s inauguration, which is likely the next important event for Bitcoin. We might witness the official announcement of a Strategic Bitcoin Reserve! Such an announcement would undoubtedly be impactful, but the details will determine the scale of its effect.

Will the U.S. simply promise not to sell its current Bitcoin holdings, which would have a mild impact, or will it commit to purchasing up to a million Bitcoin, as proposed in Senator Cynthia Lummis’s bill, which would have a much larger impact? My guess leans toward the former. It’s unlikely they would strategically announce such a significant purchase right now, even if the bill comes into play at a later stage.

Meanwhile, Bitcoin is comfortably trading near ~$100k, and from both a market cycle perspective and on-chain indicators, this bull market seems far from over! Most importantly, Short-Term Holders (STH) Supply continues to rise, signaling further continuation. Additionally, the Capital Flow indicator and metrics like MVRV remain well below their peak levels. The same goes for the On-Chain Value Map, which has yet to reach the “highly overvalued” zone.

Unlock full access to the Bitcoin Strategy Platform, featuring curated live charts, indicators, and full newsletter content. Claim your 25% LIFETIME discount today!

On the macro side, liquidity remains constrained, as illustrated in the Global Liquidity chart. Additionally, as explained in a previous newsletter, a rising Dollar doesn’t create the most favorable environment for Bitcoin. This dynamic might change in 2025, as the continued strengthening of the Dollar becomes unsustainable due to rising debt-to-GDP levels, increasing interest costs on Treasury debt, and increasing pressure on foreign borrowers, which will further reduce global liquidity. Combatting such Dollar strength through money printing will lead to asset price inflation, including Bitcoin.

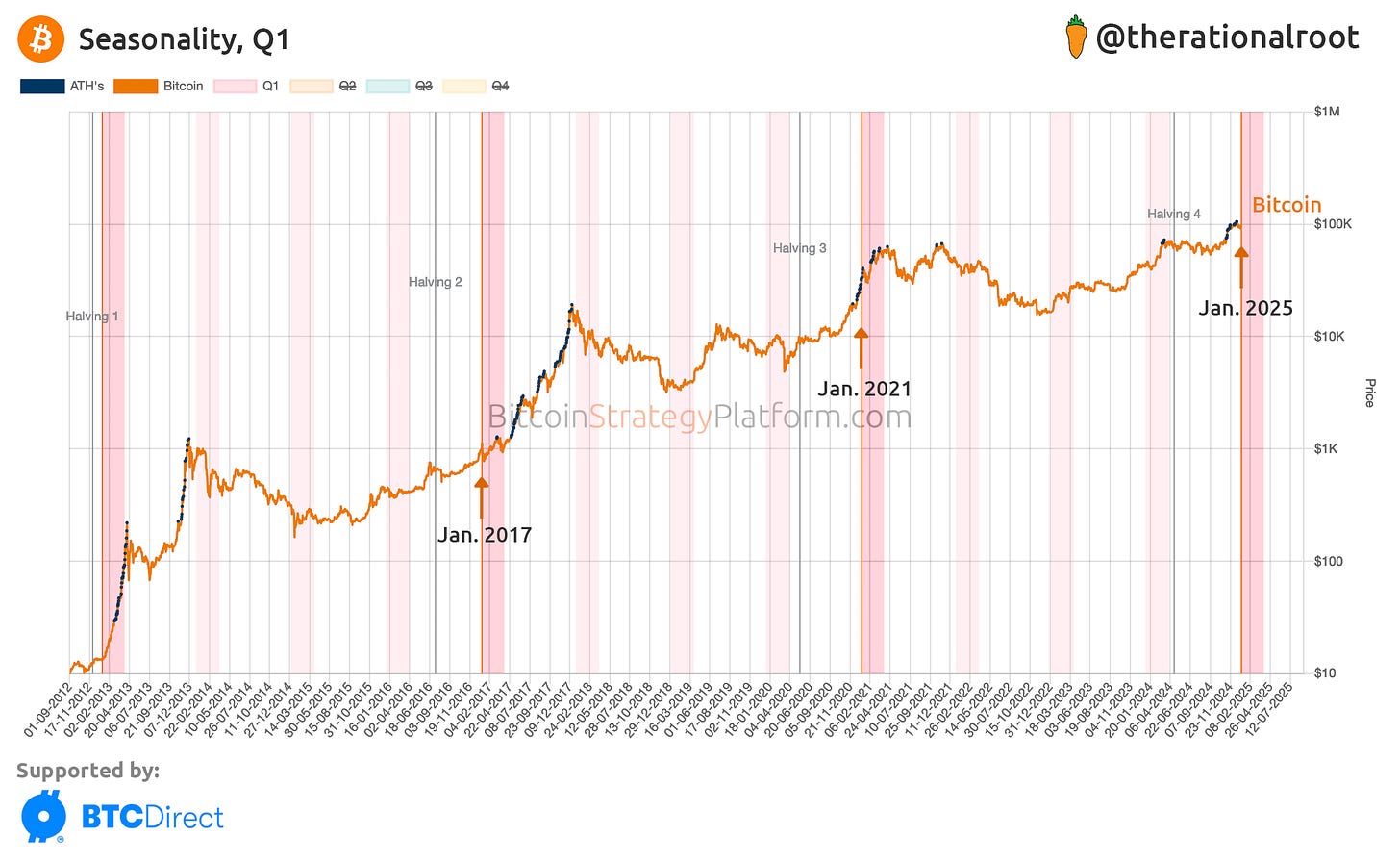

In terms of seasonality, the first quarter of every U.S. presidency, as illustrated in the chart below, has historically been quite promising.