This week, Jerome Powell, the man in central control, communicated a return to tighter liquidity. This sudden pivot caught markets off guard, leading them to immediately price in these conditions and adjust to the possibility of a stronger dollar, which affected risk-on assets like equities and Bitcoin. In this newsletter, we’ll discuss these trends.

Macro Influence on Bitcoin

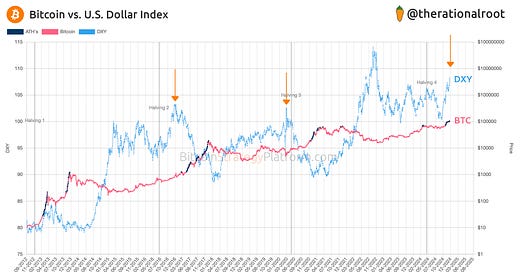

A rising DXY (US Dollar Index) signals a stronger US dollar against a basket of currencies, including the EUR, JPY, GBP, and CAD. Historically, Bitcoin has seen its biggest rallies during periods of dollar weakness, as increased liquidity fuels risk asset appetite. While Bitcoin can rise even with a strengthening dollar, its most explosive up-moves have coincided with dollar downturns.

This chart is now live and available to all paid subscribers!

Drawdown from ATH

A significant amount of leveraged longs were liquidated, causing a wick down to just above $92k. On a daily close, this amounted to only an 8.5% drop, which is nothing extraordinary for Bitcoin.

Bitcoin vs. S&P 500

Both the S&P 500 and Bitcoin experienced a volatile drop, highlighting the ongoing macro influence on Bitcoin. The correlation between these two markets remains strong.

Tracking ETF Outflows

After 15 consecutive days of inflows, Powell’s announcement triggered the first ETF outflows, showing how macro conditions influence demand for Bitcoin. View real-time ETF flows in our ETF Tracker:

Is This Pullback Over?

Could this correction be the one we've been waiting for? It was heavily influenced by Powell’s projection which could potentially act as an accelerator for a more significant correction. However, our momentum indicator remains flat and has yet to confirm such a move. Let’s continue to monitor this closely over the next days.

Unlock Platform Access: Get curated, live indicators and charts—all in one place—to keep you fully prepared for Bitcoin's cycle. Sign up now and claim a 25% LIFETIME discount!

So far, I think the volatility is nothing extraordinary—just a normal and healthy leverage flush. Momentum can, of course, shift at any time, but the market has shown remarkable resilience. This is thanks to steady ETF flows and the continued execution of the MicroStrategy playbook. Alongside previously discussed Marathon Digital and Riot accumulating, another miner, Hut8, has joined the speculative attack, acquiring nearly 1,000 BTC for their reserves.

Increased passive demand, as outlined in last week’s newsletter, could also play a stabilizing role:

Personal Update

Settling in Mexico for the winter has kept me busy and limited my activity on X. Next week, I’ll be traveling to visit family for Christmas, but I’ll do my best to stay connected and answer any questions. 👊

Thank You and Happy Holidays

I hope this newsletter provided valuable insights into Bitcoin’s behavior and expectations! One day, we’ll look back at the fiat era and be amazed at how a few individuals, like Powell, were able to influence markets with just a few words.

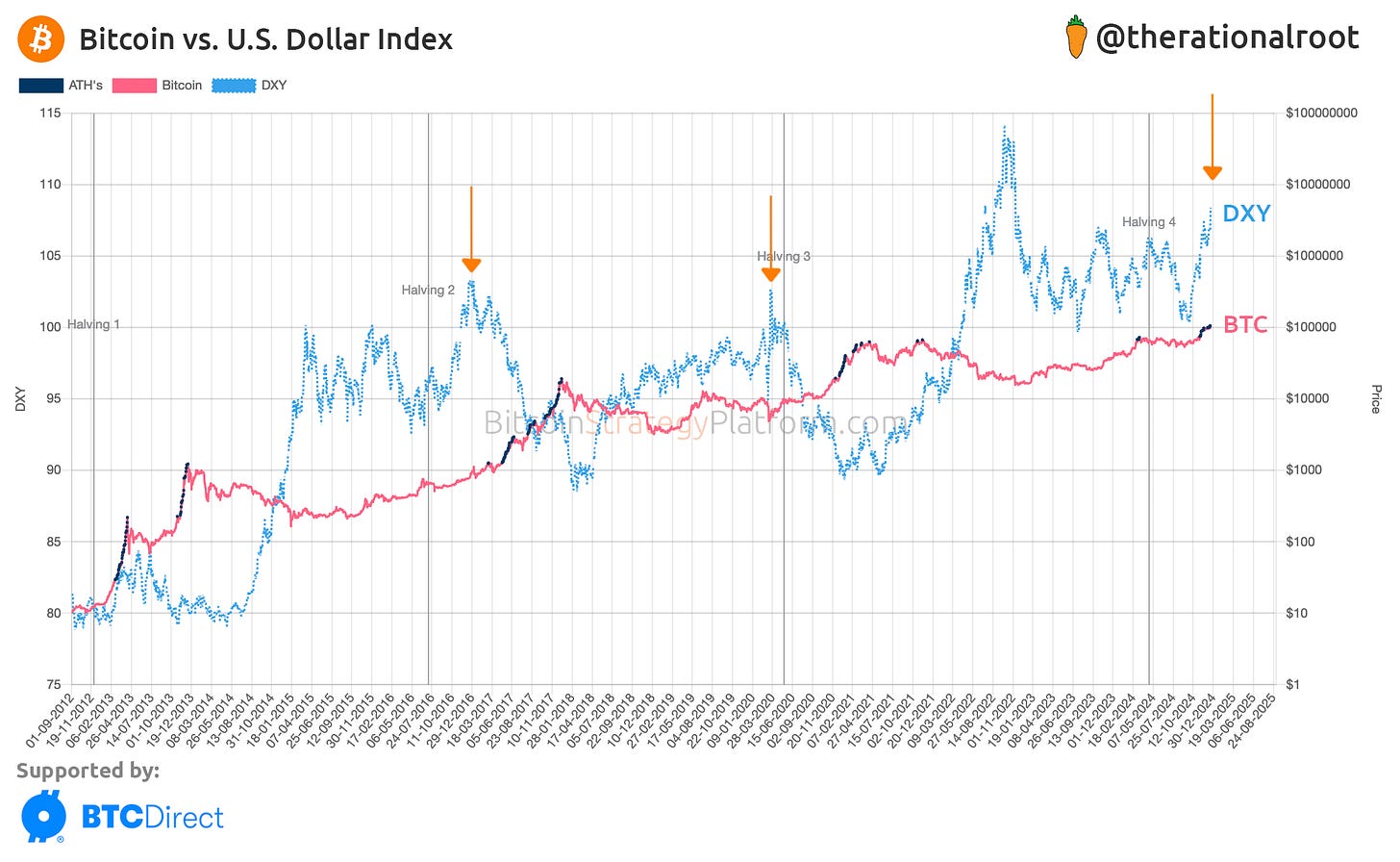

Regardless of whether we see a continued correction in the coming weeks, the outlook for the next quarter remains incredibly bullish. If you’re looking for a convincing chart to share with your family and friends over the holidays:

I sincerely want to thank you for subscribing to Bitcoin Strategy and wish you and your loved ones a blessed and Merry Christmas! 🧡

HO HO HODL! 🎄

-Root

Hi Root. is it possible to add zoom feature to STH supply indicator? it's very hard to look day by day, thank you

Thanks Root - have a great Christmas, Hanukah, holiday season everyone!