Dear Bitcoiners,

What an absolute week of chaos! Tariffs, more tariffs, 100% tariffs—no one knew what to expect, which was likely the intention: to drive demand for U.S. Treasuries, typically the world's safest asset during periods of turmoil. During the tariff chaos, gold soared, while equities, Bitcoin, and contrary to intentions, U.S. Treasuries suffered.

Last week, we covered the importance of driving demand for treasuries to bring yields down and roll over a substantial amount of short-end debt at a better rate. But as the market sold off, contrary to expectations, treasury yields went up! This led Trump to announce a 90-day pause in the trade war.

While Bitcoin initially held up well, it started dropping on the weekend (when TradFi markets are closed) and soon after made a lower low. We’ll cover the price action more extensively below, but first, let’s zoom out and understand the broader dynamics at play. You may have been bombarded with tariff headlines, but the context below is crucial to understanding the situation and the likely new regime we’re entering. Bear with me—this next chapter is key to understanding the dynamics that may impact Bitcoin’s future behavior.

Regime Change

For decades, the U.S. has run a trade deficit: as the issuer of the global reserve currency, it exports dollars and imports goods, gradually losing its own manufacturing capabilities. A classic example is the U.S. relying on China to build the San Francisco Bay Bridge because the expertise was no longer available domestically. More recently, in the Russia-Ukraine war, the U.S. has become dependent on Chinese-made weapons.

Besides losing manufacturing, the exported dollars — most of which end up in China — are often reinvested into U.S. financial markets. As a result, China not only builds the goods but also owns a stake in many of the companies selling them. Trump recognizes this imbalance and has, therefore, imposed high tariffs on China in particular.

No president in recent decades has seriously attempted to address this imbalance, as it tends to benefit the wealthy (Wall Street), even though it gradually erodes the middle class (Main Street). I’m not entirely sure what Trump’s ultimate intentions are, but relying so heavily on China and Russia certainly doesn’t make America great. It’s important to consider the possible paths forward, because they have different implications for Bitcoin.

We’ll just continue as we have for decades, ignoring the problem described above—except with perhaps slightly better trade deals (e.g., tariffs at 0 for 0). This would imply the recent tariff chaos was mainly about rolling over debt and improving trade terms, without addressing the core issues.

The high tariffs on China continue, aiming to reverse the decades-long problem. However, it’s unlikely to bring back all manufacturing, which brings us to the next point.

A middle-ground scenario is more likely, where Trump tries to reverse some of the issues while also keeping Wall Street happy.

All of these paths are highly inflationary, which in the long run is obviously good for Bitcoin. However, there’s a caveat. In scenario two and three, fewer dollars are exported, which reduces foreign demand for U.S. financial markets. This could potentially reduce demand for both U.S. equities and Bitcoin.

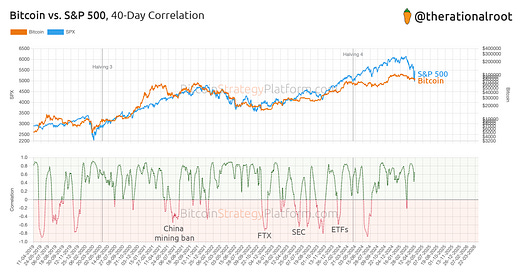

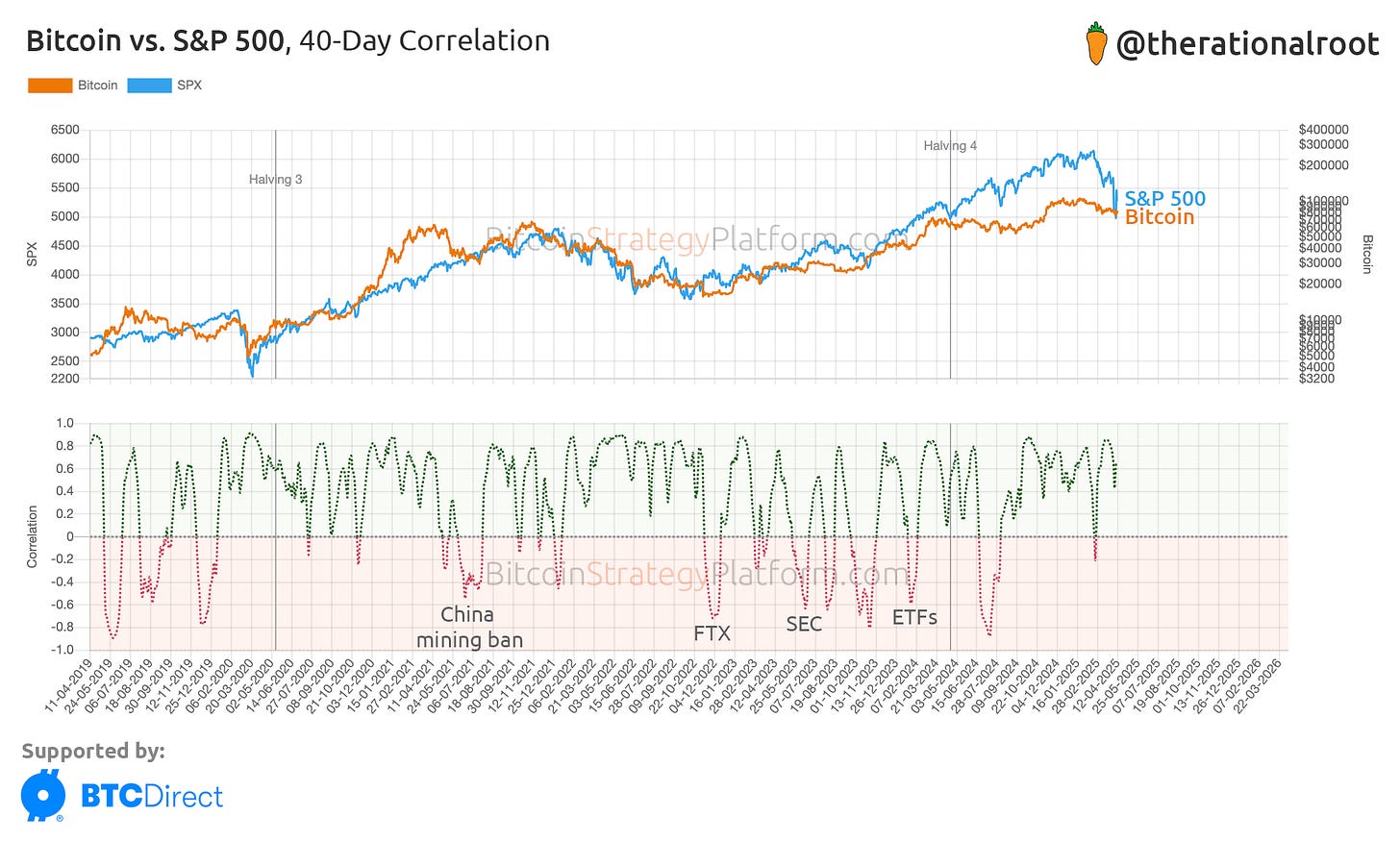

👉 Key Insight: We’re likely entering a regime change (scenario three), where Chinese demand for U.S. equities weakens. Given Bitcoin’s correlation with equities, this could mean reduced demand for Bitcoin as well.

We all know Bitcoin is its own beast, and perhaps this change will eventually lead to a decoupling—where Bitcoin breaks away from equities entirely. But for now, the correlation remains very high. Additionally, the indicators we’ve been tracking—like STH Momentum and STH Supply—show that momentum has faded. Patience is likely needed moving forward.

Gain full access to the Bitcoin Strategy Platform with all live charts and indicators. Claim your 25% LIFETIME discount today!

👉 Key Insight: Equities were overvalued relative to Bitcoin. As shown in the chart, this overvaluation has now been reset, while the correlation between the two remains high.

While we’re currently in the 90-day pause and seeing some relief, the heavy tariffs on China remain in place. This could lead to further derisking in equities. This is a time to be patient—perhaps a rate cut could be the next catalyst to reignite momentum.

Through all this chaos, Gold has been soaring!