Paper Bitcoin

Are Derivatives Suppressing the Bitcoin Price?

Hello fellow Bitcoiner,

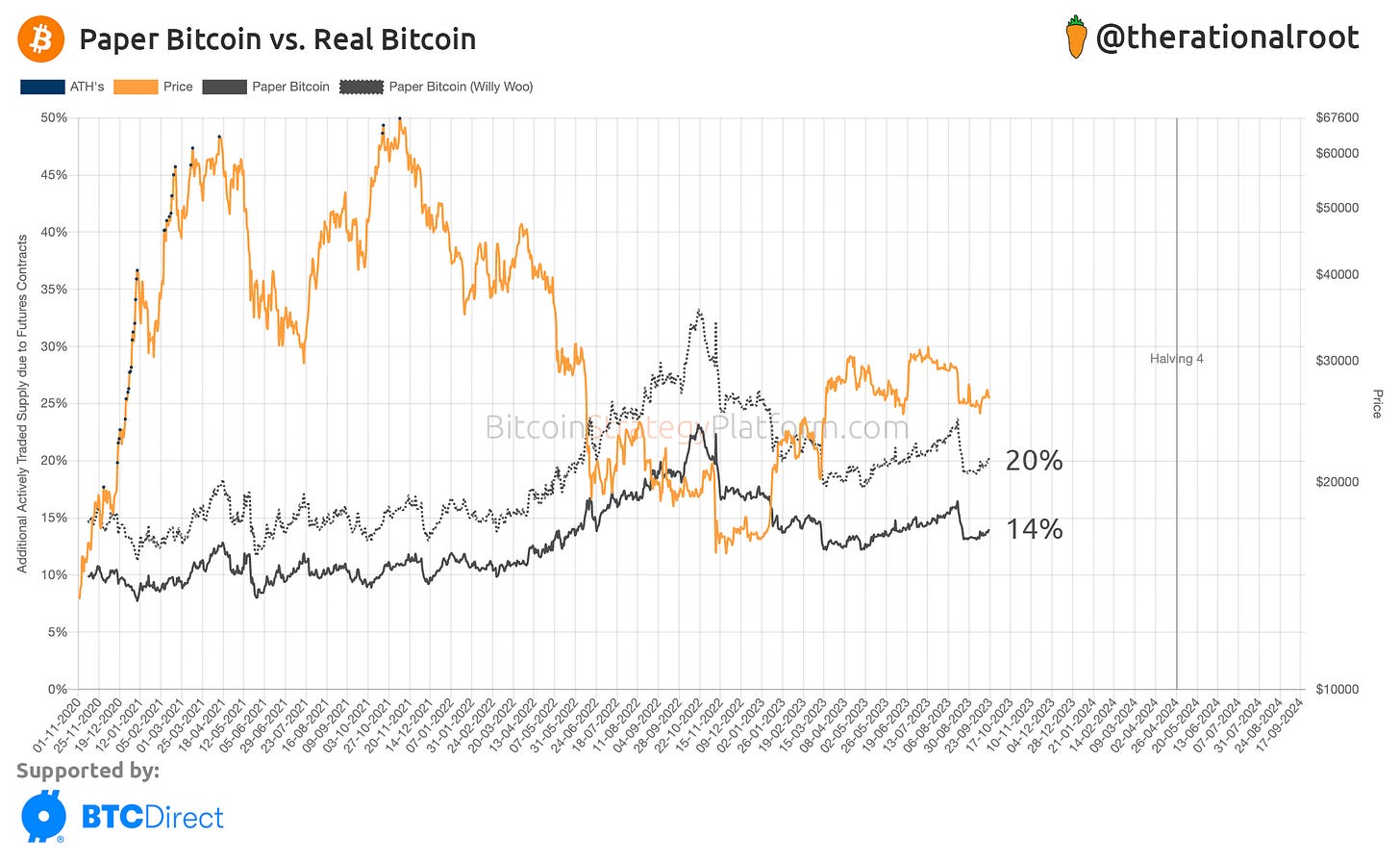

Today we're tackling a hot topic in the Bitcoin community—Paper Bitcoin. On-chain OG analyst Willy Woo has presented a provocative chart arguing that Paper Bitcoin, especially in the form of futures, could “dilute” Bitcoin's supply by up to 20-30%. Understanding this is critical for grasping how it affects price discovery and future bull market runs.

I'm thrilled to offer you the latest insights on this topic and introduce a NEW LIVE CHART, available exclusively on the Bitcoin Strategy Platform. If you find this information valuable, please consider subscribing to support my work.

Types of Paper Bitcoin

For this discussion, we'll focus only on derivatives. But remember, Paper Bitcoin can also come in the form of IOUs and even Altcoins.

Starting Point: A tweet by Willy Woo initiated this complex conversation. Differing viewpoints among experts, like Willy Woo, Preston Pysh, Dylan LeClair and myself, highlight the topic's complexity.

The Impact of Derivatives on Bitcoin

Inherited from our traditional financial system is the practice of derivative trading. Well-known Wall Street instruments like futures and options enable speculation on assets without the need to own the underlying asset. This secondary market trading has several implications for Bitcoin:

Reduced Volatility: They channel speculation away from the spot market.

Absence of the Bearer Asset: You can short Bitcoin in USD without actually holding any BTC.

Price Suppression: Secondary markets can reduce demand for the actual asset.

Examining the Data: Derivatives and Spot Price

There's little debate that derivatives have a palpable effect on Bitcoin’s spot price. To illustrate this, let's take a look at a newly updated chart.

New Chart Insights

I've revisited Willy Woo's original chart, comparing the total USD value of open interest contracts in futures trading to Bitcoin's highly liquid supply. His data indicated a “dilution” of 20-30%. However, I've extended the analysis to include a comparison with both Highly Liquid and Liquid Supply. This adjustment suggests a more modest “dilution” range of 10-20%.

👆 Live chart available at the Bitcoin Strategy Platform, under Derivatives → Paper Bitcoin.

Get access to the Bitcoin Strategy Platform with LIVE charts & Full content.

30% discount ending soon!

Unrestricted suppression

Additionally, Woo seems to imply that the derivatives market is an attack vector to suppress Bitcoin’s price by being able to sell BTC without restrictions as long as they have lots of USD.

One prime example of such suppression, which is hard to prove but many would agree on, is the Gold market. The reason why this is hard to prove and exactly the reason why I think Bitcoin is different is verifiability. Nobody can audit the Gold supply but everyone can instantly verify Bitcoin’s supply.

The Nuances of Price Suppression in Futures Trading

Another aspect worth considering is that futures trading is a two-way street: for every short position, there's a long. The market's structure prevents unlimited short-selling to suppress Bitcoin's price, as there must be an equal number of long positions willing to take the opposite side of the trade.

How Futures Could Suppress Bitcoin's Price:

Offering a high number of short contracts, risking elevated funding rates.

Consequently, reducing the demand for the actual asset, thereby suppressing its price.

Influencing market sentiment through bearish views, which could potentially affect the price further.

Points of Debate and The Way Forward

While the community might hold differing opinions on the precise impact of derivatives on Bitcoin's spot price, Willy Woo's insights offer a foundational understanding of their influence. Consequently, a logical next step is to include futures market data in our ongoing analysis.

Get access to the Bitcoin Strategy Platform

Fighting Price Manipulation with UTXOracle

To liberate ourselves from the influence of centralized exchanges and derivatives markets, developing independent tools is crucial.

Introducing UTXOracle by Steve

One such groundbreaking tool is UTXOracle, created by the innovative developer @SteveSimple and released on September 21, 2023.

UTXOracle ingeniously generates Bitcoin's price using only on-chain data, eliminating the need for third-party involvement. The script is open-source, inviting the community to utilize it. The above chart demonstrates how closely UTXOracle aligns with the average prices on major exchanges.

Why It Matters

This is a game-changer because UTXOracle uses UTXO (unspent transaction output) data to provide a fair and independent gauge of Bitcoin's free market price. As more people adopt such decentralized tools, the leverage that third parties have on market manipulation diminishes.

How Does UTXOracle Work?

In essence, people make rounded transactions in US dollars, like $100, which are then converted into Bitcoin. These transactions can be reverse-engineered probabilistically to generate a market price for Bitcoin.

Wrapping Up

The issue of price manipulation through derivatives is a complex but important topic for every Bitcoin investor. While opinions differ on the extent of its impact, tools like UTXOracle offer a glimpse into a future of more transparent and less manipulable markets. Let's keep an eye on these developments as they unfold.

Until we meet again, stay tuned for more deep dives into Bitcoin's complex market dynamics.

-Root

The price suppression is a serious concern (of mine & many) for sure. The approval of futures ETFs is proof that wall st (and its corrupt minion, the SEC) felt a need to go to their old stand by tool they can abuse to gain some control over markets.

I believe & am hopeful the fact that BTC actually can settle when its derivatives are traded will drastically limit the power of these tools. Gold is under full control it seems because essentially no one can take delivery of vast quantities of gold that are traded in futures contracts because it is too risky, too cumbersome, and way too expensive to have this gold physically delivered.

With BTC, being a digital asset, if the market gets too skewed by futures manipulation, settlement is practical and essentially lets the 'bluff to be called', which I think will keep the market more honest.

This, in addition to the transparency and the ability for anyone/everyone to hold their own keys to self custody the asset, I think will undermine the power that can be exerted as seen in the metals markets.

Brilliant analysis. I listened to Willy on WBD this week and was thinking about this topic and if it would impact price. As a buyer, I want a fair price based on real supply and demand, any other way and bitcoin would be like gold or oil like you suggest.