Dear Bitcoiners,

Earlier this week, I joined Alessandro Ottaviani, Francesco Madonna, and Johan Bergman for a live episode of the Bitcoin – Store of Value Podcast. We covered a wide range of questions on cycles, on-chain data, institutional adoption, and Bitcoin’s correlation with risk assets.

Quick summary of key discussion points:

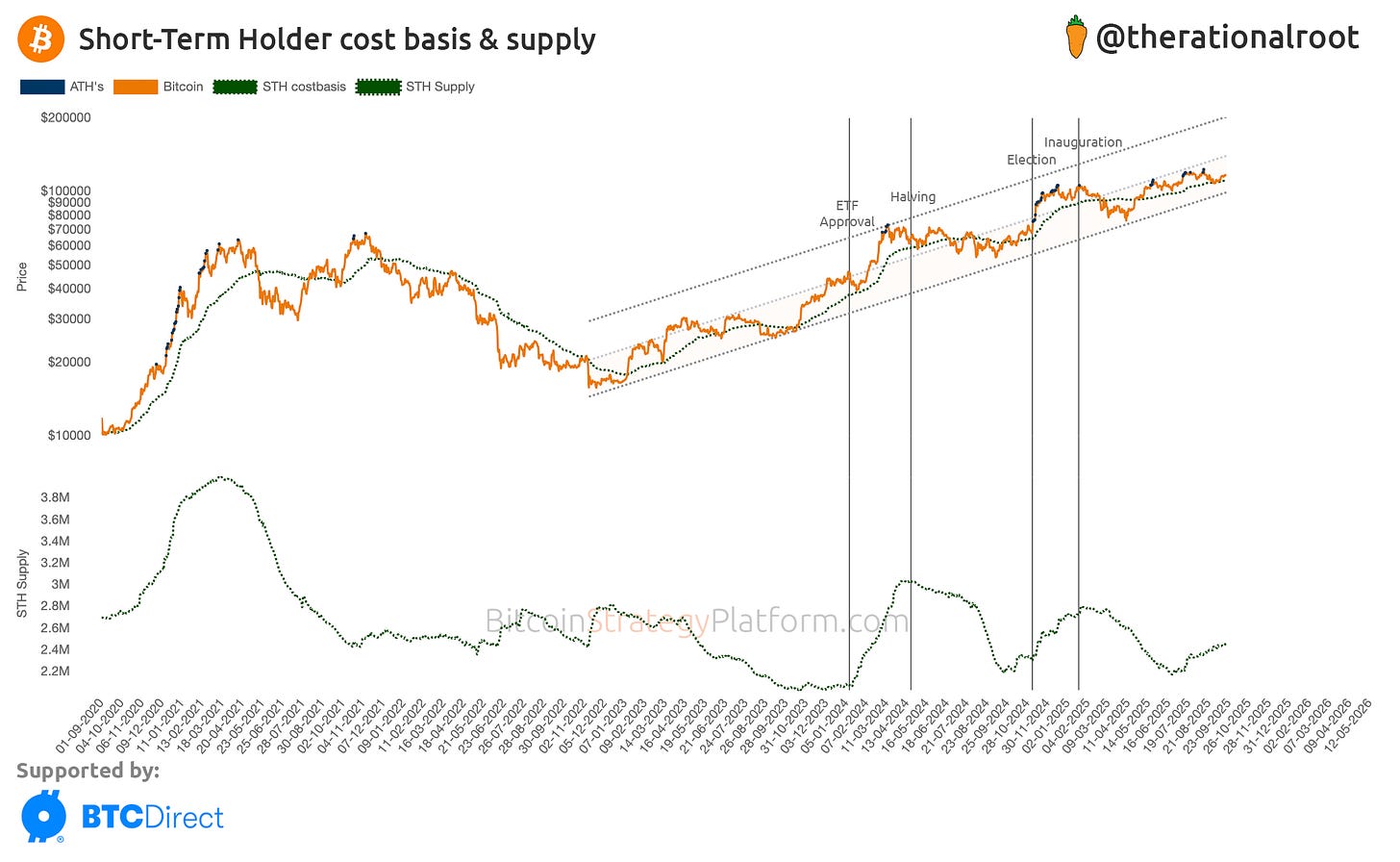

Market behavior: Bitcoin trading in the structured channel, shaped by passive flows, Hodler sell pressure, and macro conditions.

Cycle positioning: We’re approaching the final phase of the 4-year cycle. This cycle has been marked by resets and a slow grind higher, making an extension into 2026 more likely.

Institutional adoption: Q2 saw another 100k BTC added by institutions. These flows are more gradual than retail hype.

On-chain signals: Short-Term Holder Supply keeps rising, a promising sign for Q4. Using the Short-Term Holder Profit metric for spotting local bottoms.

Price action: The expected 25bps rate cut, a potential catalyst for risk assets. The rate cut is now confirmed!

If you’d like to watch the full podcast, here are the links to 👉 X (Twitter) and 👉 YouTube.

Structured Channel & STH Supply

The following chart, discussed in the podcast, is now live for paid subscribers!

Unlock full newsletter content and full access to the Bitcoin Strategy Platform. Sign up today and claim a 25% LIFETIME discount!

Next, we’ll look at another on-chain signal of major importance that’s about to trigger.