Dear Bitcoiners,

Bitcoin is once again dropping toward the $112K–$114K supply gap we discussed last week. We saw a similar pullback then, but the gap was only briefly touched. You can find that newsletter here:

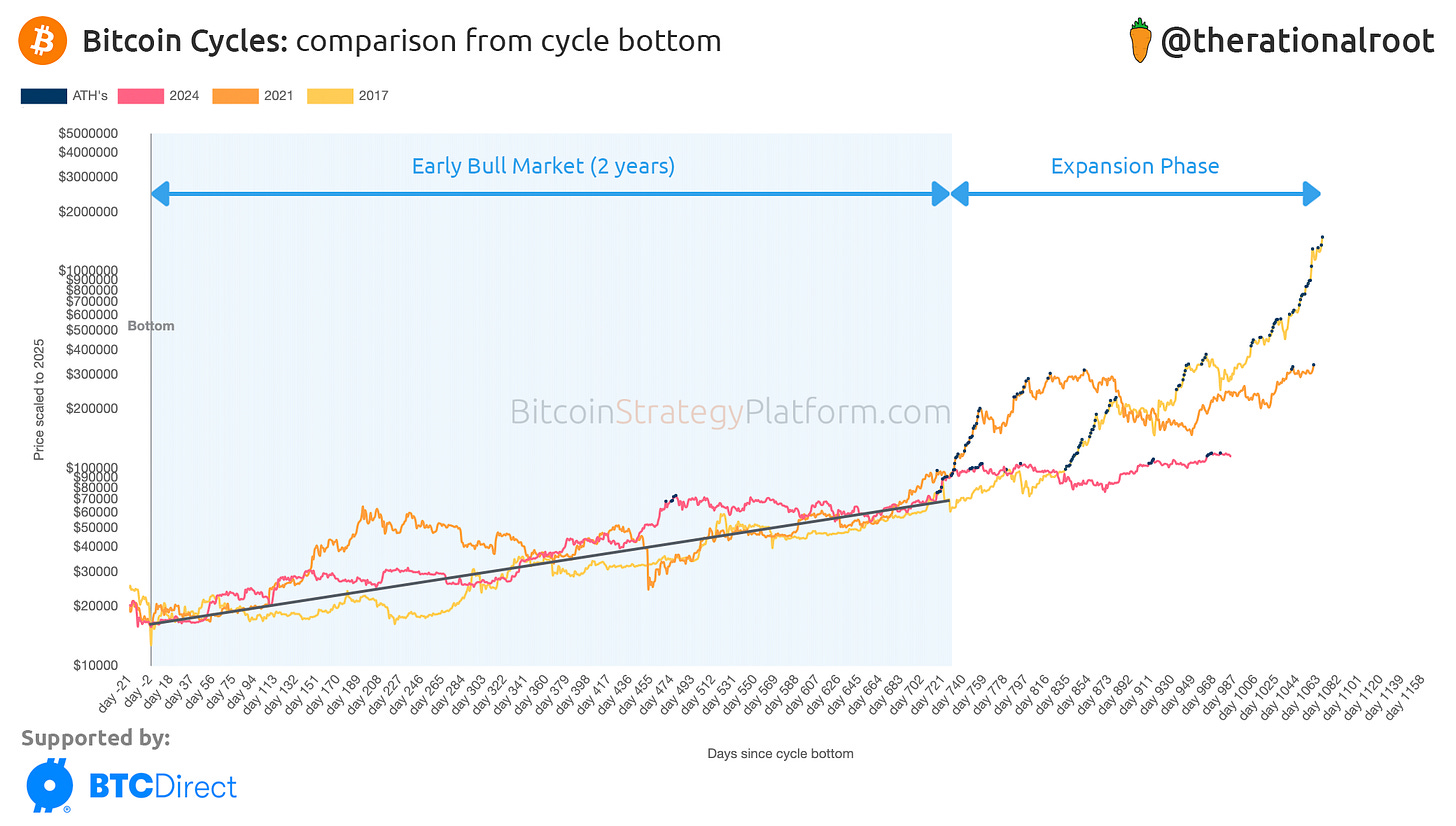

Since reaching $123K, Bitcoin has been consolidating, but based on daily close data, we’re less than 5% below an ATH. Meanwhile, the Short-Term Holder (STH) cost basis continues to climb and is now at $106K.

We’ll shortly discuss the underlying price dynamics, but first, let’s quickly recap this week’s important milestones related to Bitcoin Treasury Companies (BTCTCs) and the U.S. crypto policy report.

Bitcoin Treasury & Crypto Policy Developments

The biggest news this week, in my view, is the rapid development of BTCTCs.

Metaplanet just filed for two classes of Perpetual Preferred Stock, a major milestone! What does this mean? Similar to Strategy in the U.S., Metaplanet is now tapping into Japan’s fixed-income capital markets. In short, these preferred stock offerings may begin demonetizing the ~$9T Japanese bond market!

It’s also a huge week for Strategy, which published record-breaking Q2 results. As anticipated, but now confirmed, Strategy now meets the S&P 500’s profitability requirement, with positive net income over the trailing four quarters. Strategy could be included in the S&P 500 by the end of Q3. If so, this could act as a major catalyst for Bitcoin.

Also this week, the Trump Administration’s long-awaited crypto policy report was finally released. While it offered little that was truly new, it solidifies the U.S. Strategic Bitcoin Reserve as part of the nation’s financial strategy. The report notes that “Bitcoin in the Strategic Reserve will generally not be sold, serving instead as a strategic reserve asset for the United States.” It also takes a clear policy stance: anti-CBDC, but pro-dollar-backed stablecoins. Here’s a link to the report: www.whitehouse.gov/crypto/

Let’s now take a closer look at the dynamics playing out in this cycle.