Dear Bitcoiners,

What an absolutely insane week 🤯! It’s hard to overstate the significance of recent developments! The shift in treatment toward Bitcoin and the broader space is truly monumental. While the details surrounding the Strategic Bitcoin Reserve were disappointing, the opportunities created by pro-Bitcoin legislation in the coming years are enormous!

However, with these advancements come new risks, ranging from crypto and meme-coin hype to the potential rehypothecation of Bitcoin. In this newsletter, we’ll break it all down: the executive orders and recent changes for Bitcoin, institutional adoption, and how these trends impact the dynamics of the Bitcoin cycle!

Executive Order and Bitcoin Legislation

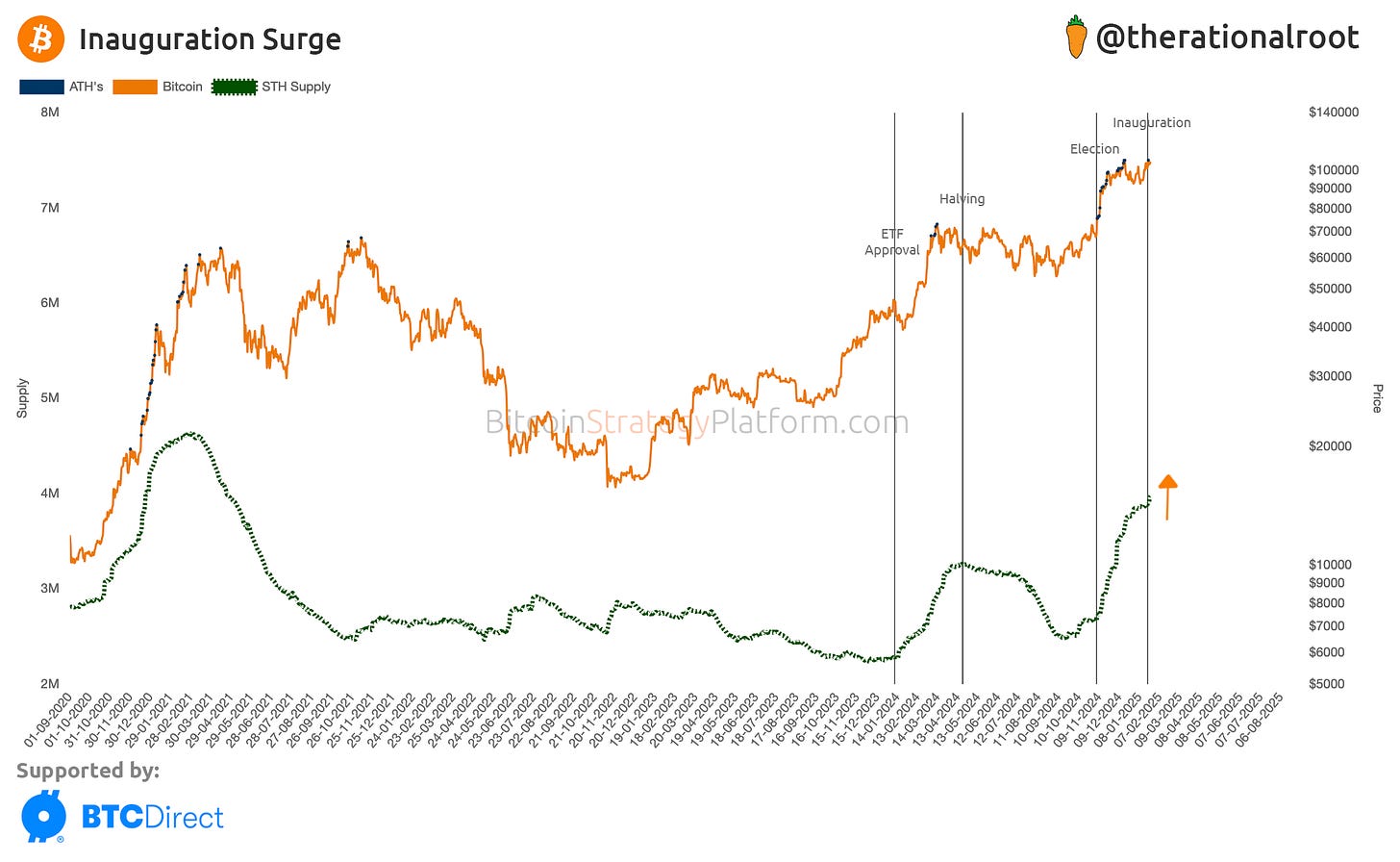

This week, the President signed an Executive Order (EO) to "make America the world capital in crypto." As a result, Bitcoin is trading near all-time highs, with indicators signaling a continuation of the bull market, highlighted by the uptrend in STH Supply!

The EO contains several strong points for Bitcoin, including protecting the ability to freely transact, self-custody, mine, and develop software, as well as opposing Central Bank Digital Currencies (CBDCs). These are all major wins for Bitcoin and the complete opposite of what we experienced under the previous administration with choke point 2.0, as discussed in last week’s newsletter:

Digital Asset Stockpile

On the Strategic Bitcoin Reserve, the EO mandates the creation of a working group on Digital Asset Markets to write a regulatory and legislative proposal within 6 months. This proposal will:

“Evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government.”

In parallel, Senator Cynthia Lummis, who wrote the Bitcoin Bill for a Strategic Bitcoin Reserve that she presented at Bitcoin Nashville, has been assigned chair of the Senate Banking Subcommittee on Digital Assets.

Both of these initiatives will complement each other, with the EO serving as a potential pilot program, while the Bitcoin Bill ensures a long-term, legislatively backed strategy.

By July 22, a formal proposal for the digital asset stockpile will be on the President’s desk. Could this be the catalyst for a bull market continuation in Q3?

Unlock full access to the Bitcoin Strategy Platform, featuring all curated live charts, indicators, and full newsletter content. Claim your 25% LIFETIME discount today!

Changing Rules for Banks: Custody and Borrowing

Another significant development was the SEC issuing Staff Accounting Bulletin (SAB) 122, which overturned the restrictive rules in SAB 121. Under the prior rules, that were introduced by the SEC during the Biden administration, banks had to record digital assets as both assets and liabilities, complicating their balance sheets.

With this barrier removed, banks can now easily hold Bitcoin in custody! With Bitcoin being the perfect collateral and its recent recognition as a mature asset, you might soon be able to borrow against your Bitcoin with your local bank!

However, this advancement also comes with risks. Fiat practices, such as rehypothecation, could introduce “paper Bitcoin”, claims on Bitcoin not backed 1:1 by actual reserves. This practice has caused significant issues in the past, including the collapse of exchanges like FTX. Preston Pysh has written a detailed article and call to action to raise awareness of these risks. I highly recommend checking it out.

Institutional Interest: The Institutions Are Here

A question raised in the Bitcoin Strategy Chat was whether institutional participation might break the Bitcoin cycle. Let’s first assess the current state of institutional adoption.

This week, at Davos, BlackRock CEO Larry Fink mentioned the possibility of a $700,000 Bitcoin price, citing discussions with a sovereign wealth fund deciding wether they should have a 2% or 5% allocation to Bitcoin.

With ETF approvals, BlackRock advocating for Bitcoin allocations, state pension funds buying in, and the MicroStrategy playbook gaining traction, Institutional interest in Bitcoin is at an all-time high. Now, let’s continue by assessing whether institutional adoption will affect the Bitcoin cycle, analyzing how different cohorts have influenced it so far, and viewing the $700,000 target in the spiral chart!