Before diving into the next subject, I want to pause for a moment and say thank you!

This week, I achieved the milestone of reaching 150K followers on Twitter. Additionally, this week, the Bitcoin Strategy Newsletter on Substack officially became a Best-Seller!

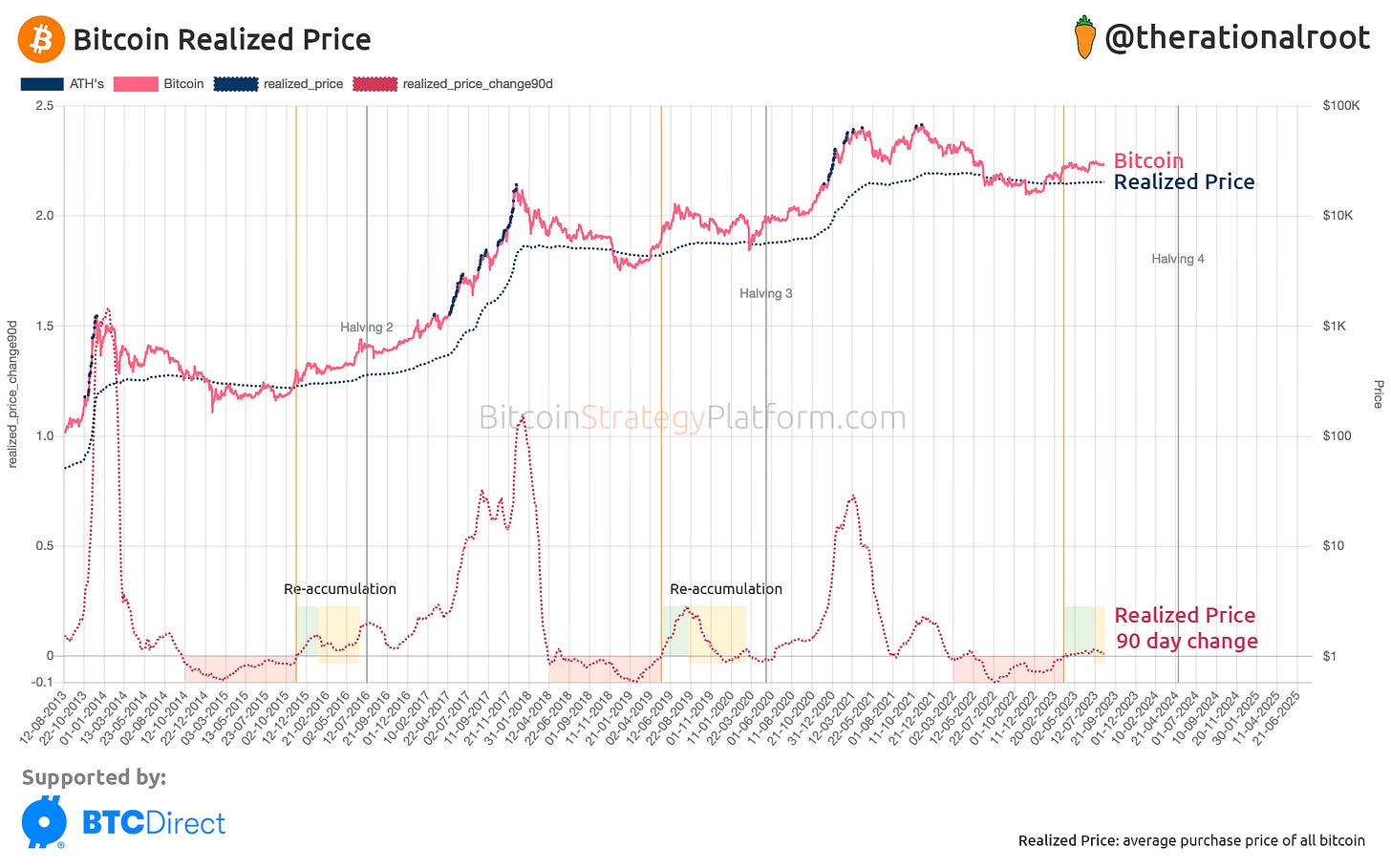

Now let’s get straight to the root of the matter: Bitcoin is in re-accumulation mode.

In the recent newsletter about Timing, we discussed how Bitcoin’s 4-year cycle consists out of three broad phases. Missed that one? It’s worth reading before continuing.

According to the timing of the 4-year cycle, we are currently in a phase of recovery and an early bull market that has been ongoing for 7 months and is expected to last at least another year. This ~2-year phase has the least volatile price action, making Bitcoin boring compared to the real bull and bear market phase.

However, during each cycle, we had a pretty strong start off the cycle bottom (green zone in below chart). Following such an impressive start, which led to a twofold increase in price during this cycle, surging from $15,000 to $30,000, the market needs time and enters a re-accumulation phase (yellow zone) before being able to continue further upward momentum. A re-accumulation phase primarily causes side-ways price action.

Being amidst the recovery/early bull market stage in the cycle, which is recognized for its reduced volatility, our present status within a re-accumulation phase further intensifies this pattern. Consequently, it's unsurprising that market volatility has reached near-record lows.

Get access to the Bitcoin Strategy Platform with LIVE charts & Full content. 30% discount ending soon!

Eventually, this compressed price action will lead to some kind of a break-out or break-down. Will we remain in an uptrend?